Update

RBI has now made it mandatory for all banks to send OTP for all kind of transactions. Hence this option has been removed. Quick Pay option has also been removed.

Most of the banks has implemented two step verification process to complete online transactions. Though they charge for it, customers are assured that even if their password is stolen, no transaction can be performed without having access to their mobile phones.

Two-step authentication includes your online banking password followed by the OTP sent to your registered mobile number. However some banks like ICICI uses the debit card grids as the extra layer of security.

What is OTP?

OTP (one-time password) is a temporary random password or pin that is valid for only one transaction or one login session. Most commonly OTPs are delivered to users via text SMS or voice call.

I strongly recommend people to opt this feature for online internet banking accounts. However in certain scenarios, like booking tickets with IRCTC, this can introduce some extra delay in getting your ticket booked. As you know, even a second counts when you are about to make a tatkal reservation. As of now SBI (State Bank of India) has started providing its user to enable or disable OTP only for IRCTC transactions. Lets see how we can do it.

Skip OTP for IRCTC Payments

Step 1: Login to SBI online internet banking.

Step 2: Go to Profile tab and click on High Security Options link.

Step 3: Provide the profile password and proceed.

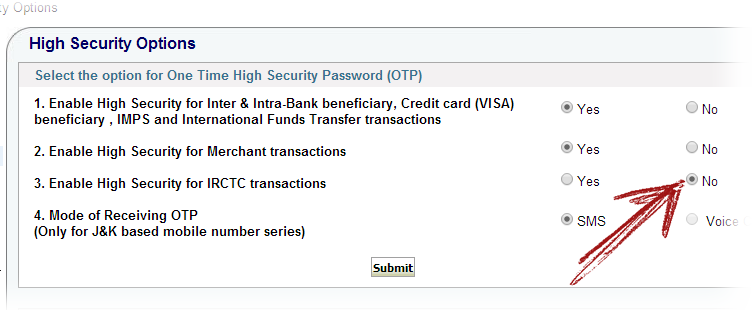

Step 4: You will see a screen similar to this. Just choose the No option button against the third option which says Enable High Security for IRCTC transactions.

Step 5: Submit the settings and you are done. Bank will no more ask you for the OTP when booking Indian Railways tickets and now you can save some more time while booking tatkal tickets.

Important to note here that if the transaction amount is more that ₹ 5,000/-, OTP check is mandatory and can’t be skipped. Also if the cumulative sum of all the transaction made on that particular day exceeds ₹ 5,000/-, then also this setting has no effect.